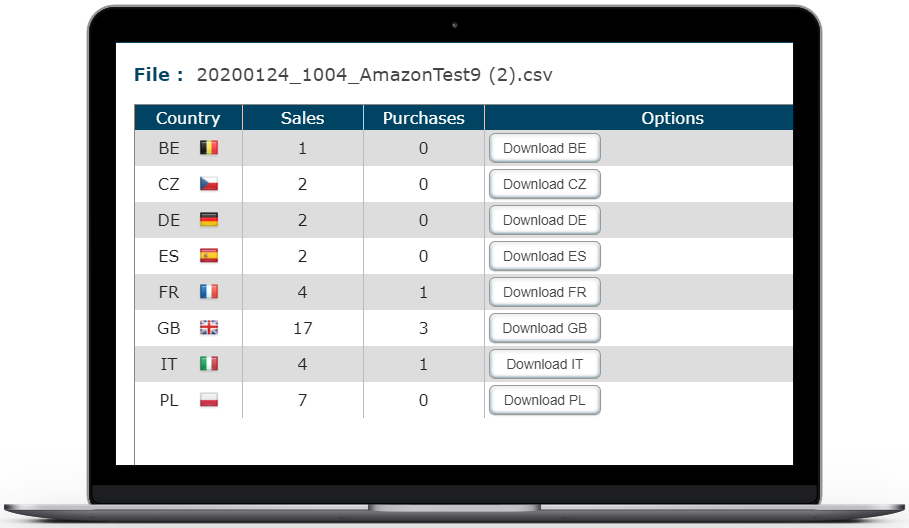

COUNTRY DATA

Automatically split Amazon data into countries

DISTANCE SELLING

Easily manage Distance Selling thresholds

Summary of Service

- Less than £50 per week

- Unlimited transactions

- Import data direct from Amazon

- Data validation tests

- Control Distant Selling thresholds

- Calculates correct VAT on all transactions

- Provides VAT reports in all countries

Why use euVAT?

Our highly advanced web-based solution enables control of distance selling thresholds, correct reporting of inventory transfers between FBA countries, above threshold sales in non-FBA countries, inbound stock transfers from non-FBA countries, all income for country of establishment returns.

In summary it provides complete control and compliance. However, it has been designed for ease of use, and hence saves significant time and cost.

Register now, or request a demo